In Stocks, Nobody Holds Perfect Pitch

- Martin Sosnoff

- Dec 25, 2022

- 4 min read

Late forties, at the High School of Music and Art, I held the first chair on clarinet. We had a great symphonic band. Annually, Leonard Bernstein, 26, would come down and conduct us. We were to play Gershwin’s “Rhapsody In Blue.”

If you remember, the piece opens with a glissando for clarinet. Three of us were eager to solo it. So Lenny said he'd turn his back and listen. Well, I lost, and was insensed. When I asked Bernstein why I lost, he answered “because your clarinet is flat.” Oh my God, I mused, he picked up the crack in the neck of my instrument. Lenny had perfect pitch, a rarity in the music world. I had good relative pitch, nothing more.

This year in the market, most everyone is down at least mid-teens. It didn’t matter whether you held growth stocks or value paper. High yield bonds now yield over 7% and you could even lose serious money in 2-year Treasuries with the yield curve so negative to 10-year maturities. As for equities, it didn’t matter whether you favored growth stocks or value sector paper. The big shrinkage hit overpriced internet plays like Meta Platforms, Amazon, Alphabet, but even Apple and Microsoft lost ground.

The analyst consensus in tech paper runs way too high, actually, foolishly so. The energy sector, pretty much held up, but few money managers played oil, except, Carl Icahn, who scored with Occidental Petroleum. The Street still seems captive to a rosy market scenario. Earnings hang in, and our FRB won’t be too punitive on interest rate hikes. This is make believe nonsense. The market is still dangerously high on historical comparisons of price-earnings ratios in an interest sensitive setting. Nobody as yet cares to deal with what’s a conservative P/E ratio, historically speaking. Everyone wishes to believe that corporate earnings shortly recover. I am seeing justifications for the S&P 500 running at least 10% above its present level of 3800. “Interest rates and inflation peak shortly while earnings recover some.” This is not someone with perfect pitch. Rather a pie in the sky thinker.

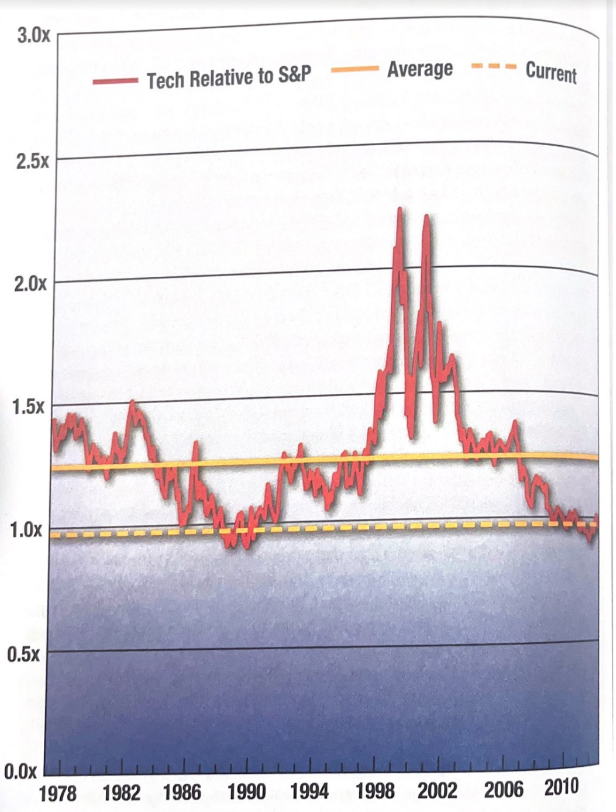

When I went to my trusty chart books first I found large capitalization tech houses rarely sell at 2 times the market’s multiplier of earnings. The market itself rarely holds onto a multiplier of 20 times earnings. Tech’s mid-valuation number is 1.5 times the market. So far few players put any weight in conservative projections for earnings and price-earnings ratios

LARGE CAP TECHNOLOGY PRICE EARNINGS

RELATIVE TO THE S&P 500

My crash helmet stays buckled on because the history of interest rates and the FED responses tend to punish financial markets, both stocks, and bonds. Two-year Treasuries now yield 4.26%. I’m tempted to buy more, but sit with a fat loss so far. My perfect pitch has zipped out the window. It’s very dangerous to ignore the country’s financial history. Paul Volcker crammed the market down to 10 times earnings in 1982. Does anybody but me remember the tension in managing money then? Today’s market would take a 50% haircut if it sold down to book value.

Note the linkage with interest rates so tied to price-earnings ratios. When Treasuries yield over 5%, the market would sell at no more than a mid-teens price-earnings ratio.

The next table on specific performance for growth, stocks and cyclicals captures nuances that can’t be uncovered in broad indices of stock groups. For example, pricey Internet stocks, like Meta Platforms, Alphabet, and Amazon, over 12 months averaged down over 50%. Likewise, Netflix and Tesla. Less extremely priced, Apple and Microsoft lost under 30%.

Non-tech stocks, exposed to the economic cycle like Walmart and Duke Energy lost 10%. Growth stocks with defensive earnings power, like Eli Lilly and United Health eased under 10%. Too. So…... If you liked growth stocks, you had to differentiate on industry groups. Now, you need to consider the coming impact of the FRB prolonging tight money. Recession probably lurks around the corner. Eli Lilly then looks better than Home Depot. Reviewing a broad group of cyclicals, you gotta single out industrials, energy, financials, airlines, and aerospace, as well as commodity plays in copper, steel and aluminum. Maybe autos.

The energy sector is easily best acting hot, not Alcoa, General Motors. Such deep cyclicals have dropped some 50% from their highs made under a year ago.

All this proves that your point of entry in cyclicals has to be well timed. Alcoa, just months ago peaked at $98. It’s low tick was $19. You caught the bottom, in AA, you tripled your money. Same goes for stocks in oil services, like Halliburton. Helluva run in any man’s language. Turbulence in the financials, particularly banks, ranged over 40%. Last thing you want to own if recession is near-at-hand are Citigroup, Bank America, even Goldman Sachs and JP Morgan.

Few Places to Hide in 2022

Growthies Cyclicals

Apple -29% Caterpillar Tractor -3%

Tesla -55% Boeing -21%

Netflix -55% Dow Chemical -30%

Alphabet -40% Exxon Mobil -8%

Amazon -50% Occidental Petroleum -8%

Meta Platforms-65% Alcoa -55%

United Health -7% US Steel -35%

Eli Lilly -4% Delta Air Lines -30%

Home Depot -29% General Motors -45%

Microsoft -30% Citigroup -35%

Walmart -10% Deere +25%

In the market, nobody carries perfect pitch, continuously. Never underestimate a level of violence. I’m attracted to airlines as a recovery spec, but playing with fire here. Energy still gets my money as a legit valuation play. Mainly, Exxon, and Occidental Petroleum. I am hanging onto reasonable growth like Apple, Microsoft, and Eli Lilly. Finally, I’ve been in love with Boeing. since I sensed they were at the bottom of their aircraft learning curve. Latent earnings power is sizable. Note Deere bucked the market.

Comments